Another contrast to the previous market peak was the speculative investments that drove a lot of the returns. The IPO market set a record in 2021 and we saw wild returns in meme stocks, SPACs (special purpose acquisition companies), and crypto. We do not see this speculative behavior today.

Comparing trailing multi-year returns for these market indices as of the end of February 2024 against the same trailing multi-year periods at the end of 2021 illustrates the exuberance that existed in 2021.

| 2/29/2024 |

3-YR TR |

| S&P 500 |

11.91% |

| Russell Mid Cap |

5.51% |

| Russell 2000 |

-0.94% |

| NASDAQ Composite |

7.69% |

| 12/31/2021 |

3-YR TR |

| S&P 500 |

26.07% |

| Russell Mid Cap |

23.29% |

| Russell 2000 |

20.02% |

| NASDAQ Composite |

34.26% |

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested.

As you can see, trailing returns are closer to long-term US equity return averages compared to 2021, which should bode well for future return prospects.

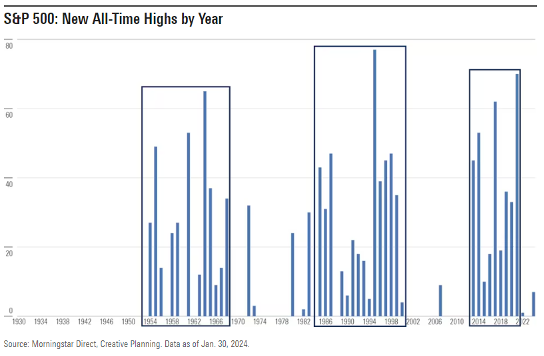

In summary, the current market environment has notable distinctions from that of 2021 and early 2022. Despite potential reservations about investing at market peaks, it’s important to remember that the stock market regularly achieves all-time highs, and today’s “peak” will inevitably be surpassed by a new market high in the future.

Securities offered through Fenimore Securities, Inc. Member FINRA, and advisory services offered through Fenimore Asset Management, Inc.

Important Disclosures

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

This presentation was prepared exclusively for the benefit and use of Fenimore Asset Management, Inc. (“Fenimore”) and FAM Funds clients to whom it is directly addressed and delivered and does not carry any right of publication or disclosure, in whole or in part, to any other party. Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

These materials contain the views and opinions of Fenimore. Additionally, the information herein is subject to change and is not intended to be complete or to constitute all of the information necessary to evaluate adequately the consequences of investing in any securities or other financial instruments or strategies described herein. These materials also include information obtained from other sources believed to be reliable, but Fenimore does not warrant its completeness or accuracy. In no event shall Fenimore be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you in evaluating the merits of participating in any transaction.

We undertake no duty or obligation to publicly update or revise the information contained in this presentation. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of Fenimore funds, or information about the market, as indicative of future results.

All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions and does not reflect actual investment results and is not a guarantee of future results. Actual results will vary with each use and over time, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment, or accounting advice.

There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.