FENIMORE ANSWERS INVESTOR QUESTIONS

FENIMORE ANSWERS INVESTOR QUESTIONS

-

The recent presidential election has certainly prompted various questions from our investors. Beyond this topic, we want to share with you answers to other questions we have received recently.

1. Does your investment research team maintain access to company management and tour their operations?

- Yes, in most cases. One of the reasons why we tend to focus on small and midsize companies is because we have better access to management.

- Fenimore’s in-house research team typically conducts more than 120 in-person meetings annually with the leaders of our holdings, and prospective holdings, and tours facilities. This direct company-level scrutiny helps us know our investments well while reinforcing our confidence in them.

-

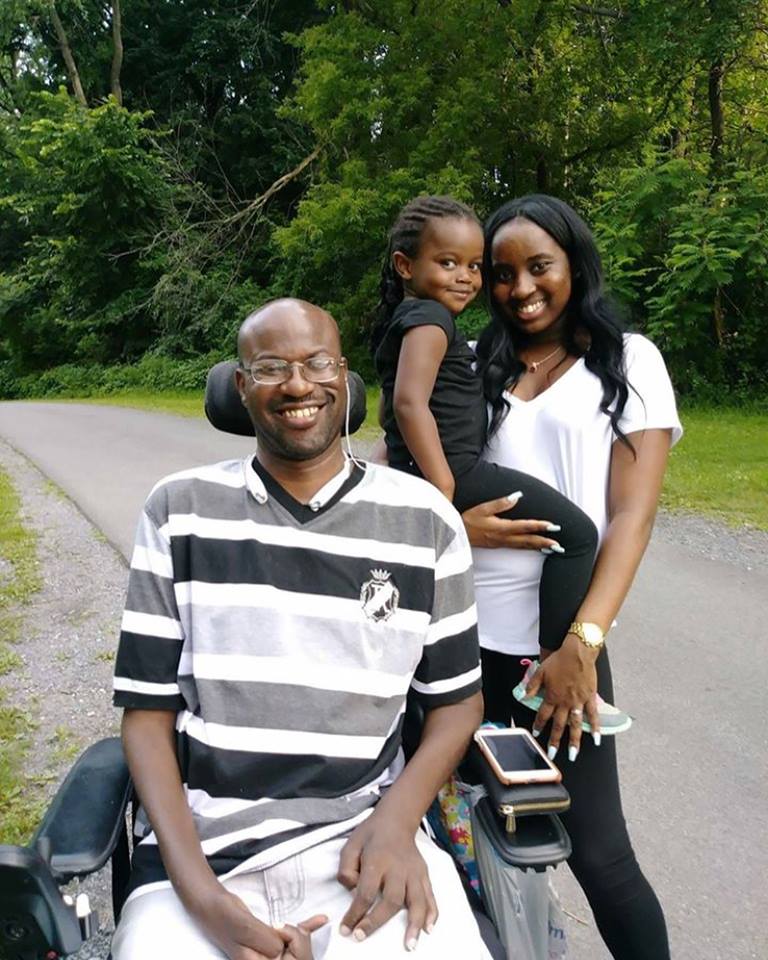

Fenimore in the Field

2. Has your investment approach changed in the past 50 years?

- Our long-term investment approach has not changed. It is a business-first approach where we seek to invest in what we believe are quality companies that meet our rigorous criteria.

- Buying a share of stock is buying a piece of ownership in a business. It’s not just a “piece of paper” to sell to a higher bidder a few months later. We approach researching a company as if we’re buying the whole business, so we want to personally know everything we can about their operation — especially their leadership team.

- At the same time, we constantly look for ways to be more efficient, leverage technology, and access industry resources so that we have even more time to conduct firsthand research in the field.

3. Since the labor pool is tight, are our companies having a hard time finding employees?

- The quality firms we seek to invest in typically have strong corporate cultures and this makes it easier to attract good employees — even in tight labor pools.

- That said, most firms have had to raise wages and salaries to attract and retain employees. One characteristic of a quality business we seek to own is the ability to raise prices to offset labor inflation.

- Lastly, many of our holdings invest in their operations to automate workforce tasks as necessary and feasible.

4. With all the hype about AI, what are you hearing from the management teams of our holdings?

- We have had numerous conversations with managers about AI (artificial intelligence). While it remains to be seen how generative AI will develop, we expect that many of our holdings will be able to use new AI based technologies to help improve the products and services they provide.

- Additionally, we believe that AI should help our businesses increase efficiency by allowing them to organize and analyze data faster than ever before.

5. How do you find new ideas?

- Sources of new ideas include a screening process using our proprietary Fenimore Quality Scores, trade publications, trade shows, peer networking, competitive analysis, and general reading. Often, we get ideas from the management teams of our companies.

- Once we identify a potential investment, the work has just begun. Next, we go through extensive due diligence and team examination. An idea must make it through Fenimore’s intensive analysis before it becomes a holding.

Learn more about how we invest