Insights

Investment Insights

VIEWS

-

Five Lessons on Long-Term Investing

In this video from a recent speaking engagement, John Fox, CFA®, shares five Fenimore lessons on long-term investing. -

Letter From Cobleskill: Autumn 2025

As the Fenimore team enters 2025’s final quarter, we are taking the wisdom we have accumulated over the first nine months of this year ― and across the last five-plus decades ― and putting it to work every day on our investors’ behalf. -

Letter From Cobleskill: Spring 2025

At a time when there is uncertainty in the U.S. economy — and, by extension, in the stock market — our Fenimore team remains keenly focused on being as certain as we can that the companies we invest in are ready for whatever the coming months may bring. Our latest Letter from Cobleskill shares insights on how our holdings are navigating today’s challenges with strength and adaptability. -

Earnings, Tariffs and Market Declines

With the backdrop of a resilient and expanding economy, coupled with prospects for pro-business tax and regulatory policies, the market entered 2025 with positive momentum, reaching a peak in February. Over the last week, sentiment has quickly shifted as uncertainty surrounding tariffs and negative revisions to corporate earnings estimates have led to market declines. From the highs, stock prices have declined to the lowest levels since September. -

Letter From Cobleskill: Autumn 2024

We are pleased with the overall performance of our mutual funds so far this year and, more importantly, over the long term. Despite our positive view, your FAM Funds team understands that you may be apprehensive about the November election looming. The interest rate environment, fears of a recession, and artificial intelligence (AI) may also be on your mind. -

Letter From Cobleskill: Spring 2024

A sense of stability has returned to the investment world as it appears that inflation is abating and the economy is growing slowly. Our team views stability with optimism and the stock market, which is forward-looking, has responded accordingly. -

Investing at Market Highs

Will Preston, CFA®—Portfolio Manager, FAM Dividend Focus Fund—notes it's important to remember that the stock market regularly achieves all-time highs, and today's “peak” will inevitably be surpassed by a new market high in the future. -

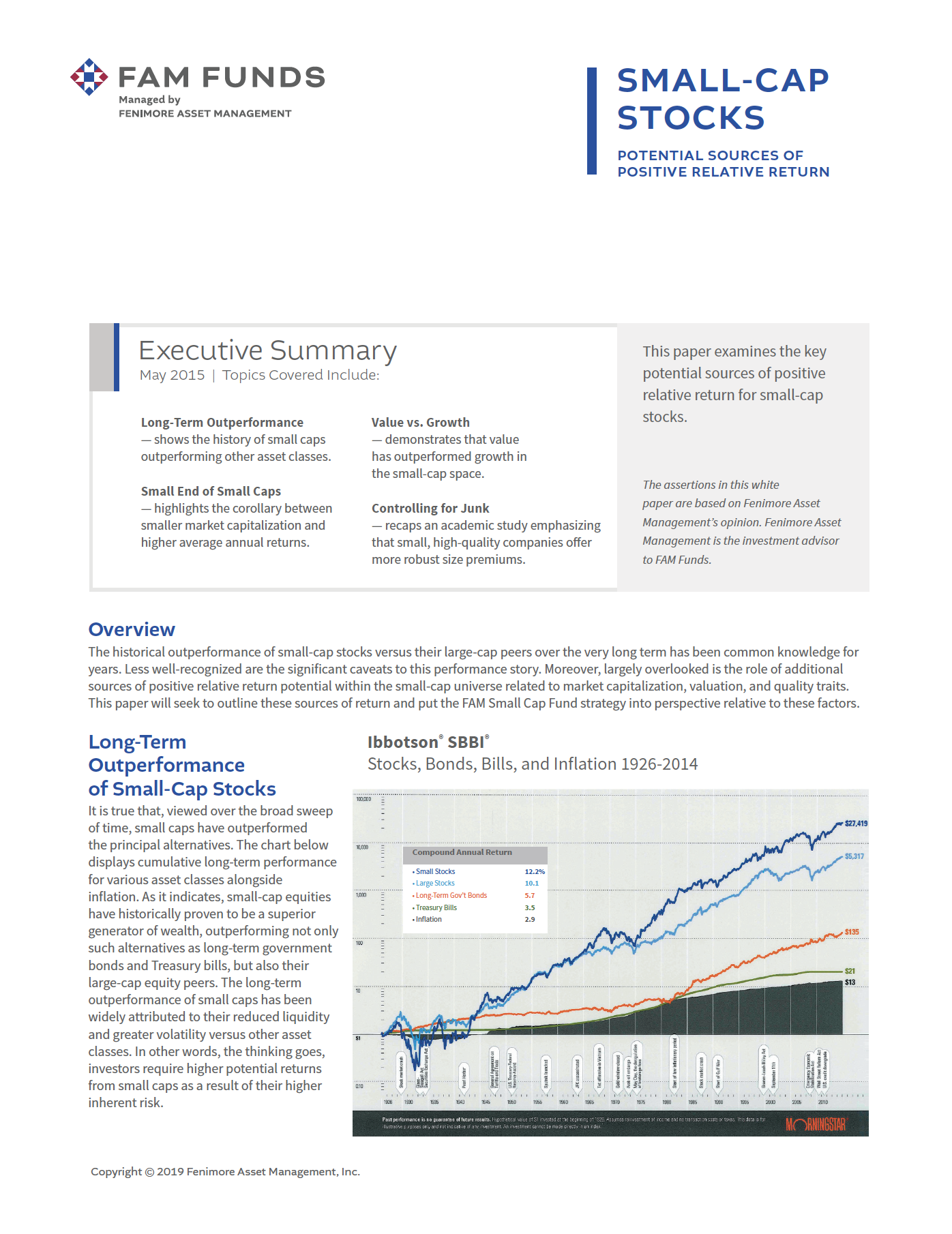

FAM Small Cap Portfolio Manager Talks Valuations

FAM Small Cap Fund Portfolio Manager, Andrew Boord, shares his thoughts on small cap valuations. -

John Fox, CIO, Joins Walter Thorne of the Albany Business Review for Albany Executive Insights

John Fox, CIO, joins Walter Thorne, Market President and Publisher of the Albany Business Review, to discuss Fenimore's investment approach. -

Letter From Cobleskill: Autumn 2023

As we head into the fourth quarter, our research team continues to hit the road and phone to talk with the companies we own and those we’re considering buying — gathering insights into their businesses, fact-checking our instincts, and seeking to ensure that the investments we’re making on your behalf meet Fenimore’s stringent criteria. -

MID-YEAR INVESTOR UPDATE: Resiliency amidst signs of moderation.

Marc Roberts, CFA — Portfolio Manager, FAM Value Fund — shares what he’s heard on moderation and resiliency coming out of Q1 earnings results. -

Letter From Cobleskill: Spring 2023

Warren Buffett once said, “What you really want to do in investments is figure out what’s important and knowable. If it’s unimportant or unknowable, you forget about it.” Discover what we think is “important and knowable.” -

Firsthand Research: We Know Our Banks

A hallmark of our investment process is to personally know what we own, and the banks in which we invest are no different. Learn why we believe our banks are different from the banks in the headlines. -

Q4 Earnings Takeaway: Strategic Capital Allocation is Key

Capital allocation is one of the most important activities management teams do based on our experience of nearly 50 years. With excess free cash, leadership has five capital allocation choices. -

Quality Investing: Its Impact During Down Markets

Fenimore Asset Management conducts firsthand research and seeks to invest in select, quality businesses. We believe it is our holdings’ collective quality characteristics that have helped our mutual funds typically outperform during down markets. -

Letter From Cobleskill: Autumn 2022

As the leaves begin to change color in Upstate New York and the nights become chilly, my fall routine kicks into gear. The first thing I do is call my perennial firewood supplier to negotiate the price and place an order. After much friendly banter during our recent call, this hard-working entrepreneur said that there will be a large price increase in 2022. Higher labor, gasoline, truck and equipment maintenance, and overall operational costs give him no choice but to raise the price. This pattern is being repeated throughout our economy. -

Firsthand Research Gives Us Confidence

It’s these in-person meetings — a longtime tenet of Fenimore’s research process — that help us gain a better understanding of the current macroeconomic challenges facing businesses while reinforcing our confidence in our holdings’ abilities to persevere and potentially thrive during a variety of environments. -

Investor Update — June 2022

William Preston — Portfolio Manager, FAM Dividend Focus Fund — shares his thoughts on oil prices, inflation, and why we are still confident despite these turbulent times. -

Investor Update — May 2022

Fenimore’s CEO John Fox conveys his thoughts on the current environment. “I want to contrast this with Fenimore’s holdings which, in our opinion, are competitively advantaged firms with significant cash profits and reasonable levels of debt. No matter what happens in the economy or markets, financially strong companies can weather the storm.” -

Letter From Cobleskill: Spring 2022

Fenimore continues to invest toward a return to “normal.” This means focusing on quality companies that meet our rigorous standards and have the ability, in our opinion, to weather the challenging times and excel when the environment is better. -

Research on The Road: Face-to-Face Meetings

After two years of limited travel, Fenimore’s analysts are back in full swing meeting with management teams in person. Discover what they’ve learned. -

2022 Stock Market Update

"I have been at Fenimore for 26 years and in every one of those years, but one, the market had a decline of 5% or more during the year. This is a normal part of stock investing.” — Fenimore’s CEO John Fox -

Volatility, Inflation, Interest rates, & Supply Chain

The market volatility over recent weeks has caused a great deal of uncertainty and has left many investors with unanswered questions. Portfolio Manager Marc Roberts provides answers. -

Our Fundamental Analysis Gives Us Confidence

Investors often ask me, “How does Fenimore manage its investments so confidently when the future is so unsure? ”My answer, “You don’t have to know the future, but you do have to know your companies.” -

Fenimore’s 2021 Year-End Newsletter

Fenimore Asset Management’s 2021 newsletter features: Investment Insights from CEO John Fox, “You don’t have to know the future, but you do have to know your companies;” President Deb Pollard’s message on Fenimore’s commitment to delivering useful investment knowledge to you when and where you want it; and more! -

Q3 Earnings: Resilient Small Caps

Q3 Earnings: Resilient Small Caps — FAM Small Cap Fund Portfolio Manager Kevin Gioia shares Q3 earnings insights on what we are hearing and seeing from small-cap companies. -

A Quarter Century of Finding Value in Dividend-Paying Mid-Cap Companies

Before the internet boom went bust in the early 2000s and prior to FAANGs dominating passive investors’ portfolios, one mutual fund strategy found that the most straight forward approach led to creating long-term wealth via investing in great companies. -

Letter from Cobleskill – Autumn

Since the pandemics onset, we have taken two steps forward and one step back on several occasions. This is another one of those times. Corporate earnings for 2021’s first two quarters exceeded expectations and stock prices followed upward. -

Meeting with Management: Getting Informed and Building Relationships

Ever since Tom Putnam established Fenimore in 1974, he has maintained the practice of getting out from behind the desk and meeting in-person with management teams, a key tenet of Fenimore’s research process. -

FAM Dividend Focus Fund: 6 Key Lessons Learned

As we celebrate 25 years of service to our shareholders, we’re pleased to provide an insight into 6 Key Lessons Learned along the way that have helped contribute to the Fund’s long-term success. -

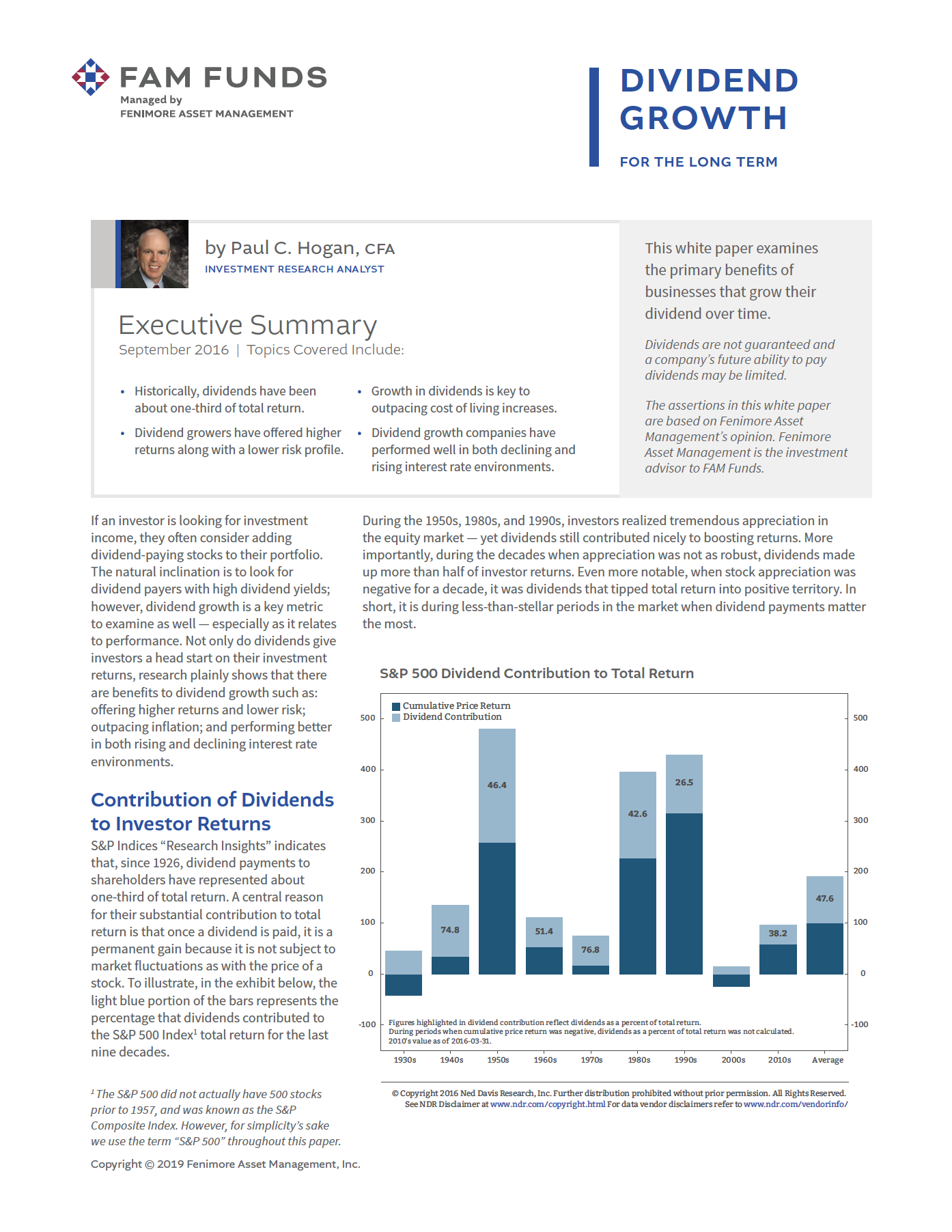

25 Years of Distinctive Dividend Investing

Dividend investing has been around for over 100 years, but for the last 25 years Fenimore Asset Management has been implementing its own style of dividend investing through the FAM Dividend Focus Fund by investing in the growth potential of the dividend over the long term versus its current yield. -

Key Reasons Why Fenimore Avoids Short Squeezes

By Andrew Boord, Portfolio Manager – Fenimore Small Cap Strategy. There is much discussion lately about highly shorted stocks getting squeezed higher, like GME (GameStop Corp.) — not a Fenimore holding. -

“America’s Small Stocks Are Leading the Market’s Charge”

Is it time to give small-cap stocks a fresh look? Discover Fenimore’s small-cap strategy and what makes us different. -

2020: Lessons Learned & Our Outlook

Our lessons learned in 2020 would take up volumes, but there is an axiom that was strongly confirmed: The stock market is not the economy. -

Stress Testing Banks During the Pandemic

Fenimore Small Cap Strategy Portfolio Manager Andrew Boord details how we evaluate the survivability of banks. -

Fenimore 2020 Year-End Newsletter

BETTER DAYS AHEAD? We think so. CEO John Fox elaborates in our 2020 Year-End Newsletter.