Investor Update — May 2022

Investor Update — May 2022

-

Insert Text here

As we came into the new year, the consensus was that the U.S. economy and earnings of American companies would grow. Perhaps at a slower rate than 2021’s pace, but still grow. It was also well understood that the Federal Reserve (“the Fed”) would be reducing the stimulus put in place at the pandemic’s onset, meaning they would increase short-term interest rates to cool off the rate of inflation.

As 2022 is unfolding, two events have increased the rate of inflation and forced the Fed to act quicker and, perhaps, with more intensity than previously expected.

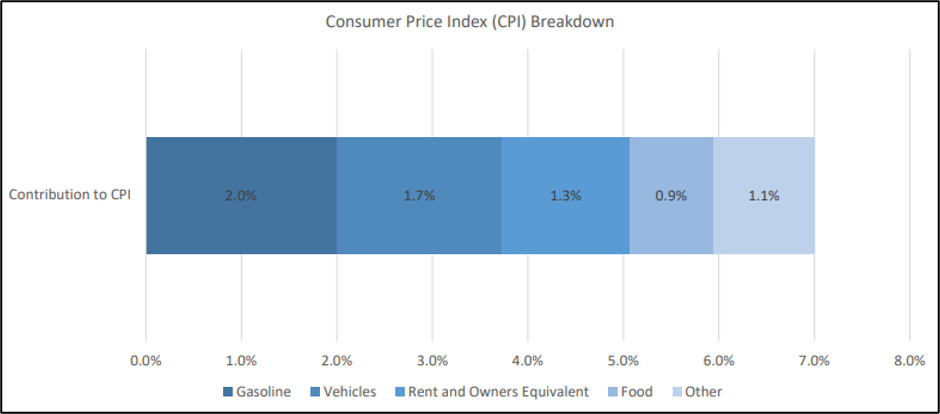

- Russia’s invasion of Ukraine has put upward pressure on energy and food costs. Russia is one of the largest producers of oil in the world and a large share of the world’s wheat supply comes from the Russia/Ukraine region. The inflation report released this morning (5/11/2022) shows significant year-over-year increases in both energy and food costs.

- China’s zero-COVID policy is resulting in factory and port closures there. As China is a major exporter of parts and finished products, these closures are causing American businesses to scramble to obtain products they need. In many cases, they are paying significant premiums for airfreight or other logistics options. To cover these transportation costs, domestic companies may pass them on to their customers in the form of higher prices.

- Russia’s invasion of Ukraine has put upward pressure on energy and food costs. Russia is one of the largest producers of oil in the world and a large share of the world’s wheat supply comes from the Russia/Ukraine region. The inflation report released this morning (5/11/2022) shows significant year-over-year increases in both energy and food costs.

-

CEO John Fox, CFA

“I want to contrast this with Fenimore’s holdings which, in our opinion, are competitively advantaged firms with significant cash profits and reasonable levels of debt. No matter what happens in the economy or markets, financially strong companies can weather the storm.”John Fox, CEO

One of the potential outcomes of higher interest rates and energy costs is that they slow the economy so much that we experience a recession.

You have heard us say that stock prices follow earnings and, in a recession, it is normal for company profits to decline. The stock market is trying to figure out if we will have a recession and, if so, when. Of course, no one knows the answer and this is creating volatility in stock prices. The one thing we do know about recessions is that they end and a new cycle of growth begins.

Corporate Profits

An interesting aspect of the current “recession watch” is how strong corporate profits are today. Our Investment Research team recently finished digesting a couple hundred earnings reports for the quarter ended March 31, 2022. Earnings continue to grow and, in some cases, companies have reported record results. In cases where earnings are down, it is usually due to temporary factors like elevated transportation costs. We don’t know if there will be an overall decline in earnings at some point, but we are watching results carefully.

Additionally, our analysts continue to travel and meet with our holdings’ management teams — we just visited two in Dallas and Richmond — to ensure that we have our finger on the pulse of their operations.

- A noteworthy point: Some of the largest declines in the stock market this year are from speculative companies that may not be profitable, generate cash flow, or have an established business model. I want to contrast this with Fenimore’s holdings which, in our opinion, are competitively advantaged firms with significant cash profits and reasonable levels of debt. No matter what happens in the economy or markets, financially strong companies can weather the storm.

Looking Ahead

During these uncertain times, we can tell you with certainty that we remain committed to Fenimore’s investment philosophy and tenets that have successfully guided us through difficult times in the past. We believe that our holdings will partake in future growth because their management teams are focused on shareholder interests and they possess strong financial footings to help them endure the current decline and prosper when the markets recover.

We’re Here for You

Please contact us with any questions or concerns at 800-721-5391, through our website’s “Contact Us” section, or via info@fenimoreasset.com. Our team also welcomes you to meet with us in either our Albany or Cobleskill location or virtually.