Volatility

Fenimore believes volatility creates opportunity. While we would all like a long-term, never-down performance experience, the reality is that markets do fluctuate — they always have — and it is through those fluctuations that some of the best opportunities present themselves.

At Fenimore, we are staying the course and will:

- Continue to evaluate the companies we own. While this is always happening at Fenimore, we consider these particularly important times to be assessing all aspects of our investments, and whether there are other opportunities that we can take advantage of at this time. As we like to avoid overpaying for the companies we invest in, we seek to find great value in buying during times of market stress.

- Work with our clients to do the same and to think about these as opportune times to add capital to their accounts — to invest more at a time when prices are a bit lower. Over the long term, this should make a significant difference in the overall return and growth of their savings.

Learn More

Inflation & Interest Rates

Over a prolonged period,[1] multiple decades, interest rates have remained low. While interest rates are up off the bottom, they are still very low by historical standards. These low rates typically support high valuations for financial assets like stocks and real estate.

Will they rise? Will inflation be permanent at a high level forcing interest rates to go up? These are questions that we ask ourselves frequently. Although we have no crystal ball to predict the level of inflation and interest rates, the recent headline inflation figure of 7% was elevated by several factors that may not reoccur:

- The base-rate effect — 2021 prices were relative to 2020 levels when the economy was shut down

- A rebound in energy prices that should not repeat to the same magnitude

- Increases in new and used car prices driven by a shortage of semiconductors that is limiting the ability to build new cars

- The mismatch of huge stimulus created demand coinciding with a virus constrained supply chain

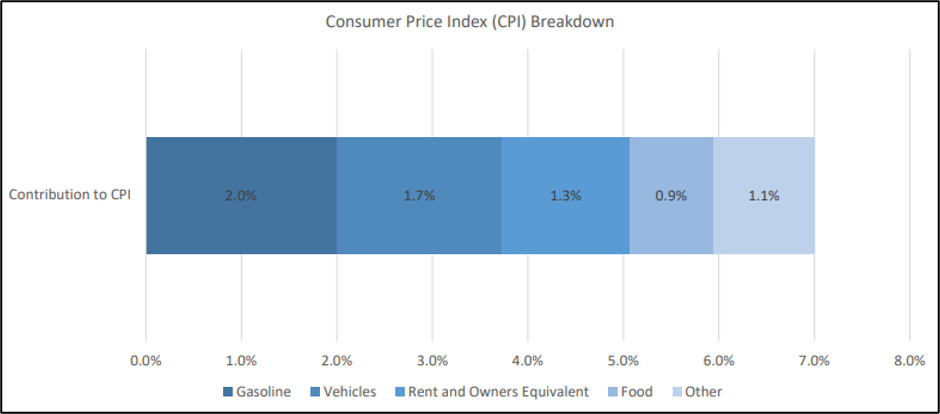

The Consumer Price Index (CPI) measures the average change in prices over time paid by consumers for a basket of goods and services. The CPI chart below illustrates the 5 key categories that account for the 7% increase in inflation, with gasoline and vehicle prices representing more than 50% of the increase as of December 2021.[2]

As the aforementioned factors show a reduced impact, we would expect headline inflation readings to soften. On the other hand, we must acknowledge that not all factors impacting inflation figures will reverse. Higher wages, living expenses, and increased prices for value-added goods and services may be here to stay.

Supply Chain

Supply chain factors should get resolved over time. Corporate management teams are reacting to the challenging environment — manufacturing locations are being reconsidered, capacity is being increased, and new sources of supply are being uncovered. In addition, pandemic-driven bottlenecks should unwind as businesses continue to adapt to today’s operating environment. Over time, as supply rebalances, inflationary pressures from the supply chain should ease.

The bond market seems to know all this, which is why forward-looking prices in the bond market have the inflation rate over the next 10 years estimated at about 2.5%.[3] We will continue to monitor these market-based expectations closely.

Fenimore’s View

At Fenimore, we consider ourselves as your trusted investor. Our active investment approach since 1974 has helped us navigate multiple economic and financial market cycles. This proprietary, research-intensive process reinforces active oversight and incorporates:

- Creating and maintaining detailed models for each company we follow

- Analyzing financial statements

- Meeting with management and participating in quarterly conference calls

- Speaking with suppliers, customers, and competitors

- Monitoring the potential business impact of macroeconomic events

- Sifting our investment ideas through four investment criteria filters: Quality Business, Financially Durable, Proven Management, Margin of Safety

In our experience, this proactive process helps us manage risk, especially during downturns, and can be one of the better ways to potentially grow wealth over the long term and outpace inflation. Our investment research team will continue to be active and take the long view and look for opportunities to invest more in what we believe are quality businesses — both among our current holdings and in enterprises we’ve admired and desired to own but were too richly priced for us.

We can never know the future, but our team knows our holdings — both the businesses and the management teams. This gives us the confidence we need to execute Fenimore’s long-term strategy: buying stock in what we deem to be quality businesses that meet our rigorous standards and are ideally positioned to do well in good times and persevere through adversity.

What Should Investors Do?

As advisors well know, the key is to have a comprehensive, understandable, long-term investment plan that can serve as a foundation — it is hard to stay the course if you do not know the course.

The better you understand what you are invested in and why, the more confidence you have in your investments. Fenimore’s distinctive, firsthand knowledge of the companies behind your investments is crucial and helps to maintain a long-term focus regardless of any stock market, economic, or geopolitical uncertainty.

Fenimore Asset Management: Fenimore, manager of the FAM Funds, has been providing differentiated investment management solutions for nearly five decades. Learn more about our unique history and how we partner. Call 800-721-5391.

[1] https://fred.stlouisfed.org/series/DGS10

[2] https://www.bls.gov/cpi/tables/supplemental-files/home.htm

[3] https://fred.stlouisfed.org/series/T10YIE