FAM Small Cap Update

FAM Small Cap Fund Update

John Fox, Chief Investment Officer (CIO), is retiring in December after a successful 30-year career at Fenimore. His professional and personal contributions have made a positive impact on our investors, firm, and community. We hope that John enjoys his well-deserved retirement and express our heartfelt gratitude for his dedicated service!

FOCUSED ON YOU

Fenimore Founder and Executive Chairman Tom Putnam built the framework for a long-term succession plan years ago to ensure the continuity of our investment philosophy and investor experience for decades to come. Fenimore’s succession planning is thoughtful, enduring, and seamless ― always keeping our investors’ best interests in mind.

When associates retire, our highly collaborative process keeps operations running smoothly. Each of the three investment strategy teams (Value, Dividend Focus, and Small Cap) works together as a cohesive unit. They implement our market-tested approach in pursuit of performance excellence, just as they did during John’s time as CIO. What this means is that the teams who pick our stocks remain the same.

Fenimore’s research analysts include three astute industry veterans of more than 30 years as well as generations of talented professionals. We look forward to sustaining our collegial environment as we diligently seek to grow your assets over the long term.

Fenimore Asset Management, an independent, Capital Region-based investment advisory firm and manager of the FAM Funds family of mutual funds, announces that Hunter Frayne was promoted to Investment Research Analyst after earning his CFA® (Chartered Financial Analyst®) designation.

Mr. Frayne is responsible for conducting firsthand, company-level investment research and adhering to the firm’s market-tested approach. Previously, he served as a Fenimore Investment Research Associate. Mr. Frayne graduated with honors from the University of Connecticut with a double major in economics and philosophy.

“Hunter is a talented professional with strong values and a passion for our investment philosophy,” said Fenimore’s Chief Investment Officer John Fox. “We are pleased to recognize his contributions to our in-depth research process. Hunter’s insights and analytical abilities should continue to help our investors over the long term.”

Hunter Frayne, CFA®

Investment Research Analyst

Fenimore Portfolio Manager, Will Preston, CFA®, shares his thoughts on investing at market highs.

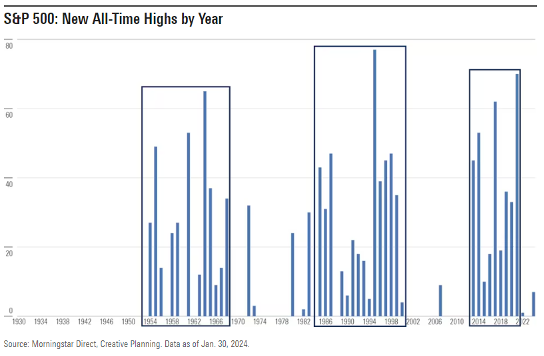

The stock market has hit 14 “all-time” highs in the first two months of 2024. While this is great for portfolios, we understand it can also raise concerns about investing at market highs, particularly given the 9-month, -25% bear market that followed the last peak in early 2022. I’d like to reassure you that a long-term view is what matters most.

Compared to the last peak in January 2022, today’s investing backdrop is very different. In January 2022, inflation was +7.6% and rising, along with growing expectations that the Federal Reserve would have to raise interest rates to combat the persistent inflation. This of course turned out to be true with interest rates increasing 11 times in 16 months.

In February 2024, inflation, as measured by the Consumer Price Index, increased 3.2% year-over-year and has been trending down, supporting investor expectations that the Fed will not need to hike rates again this cycle. While some focus will remain on when the Fed will begin cutting interest rates, long-term company value creation continues to come from businesses growing earnings and cash flow.

Another contrast to the previous market peak was the speculative investments that drove a lot of the returns. The IPO market set a record in 2021 and we saw wild returns in meme stocks, SPACs (special purpose acquisition companies), and crypto. We do not see this speculative behavior today.

Comparing trailing multi-year returns for these market indices as of the end of February 2024 against the same trailing multi-year periods at the end of 2021 illustrates the exuberance that existed in 2021.

| 2/29/2024 | 3-YR TR |

|---|---|

| S&P 500 | 11.91% |

| Russell Mid Cap | 5.51% |

| Russell 2000 | -0.94% |

| NASDAQ Composite | 7.69% |

| 12/31/2021 | 3-YR TR |

|---|---|

| S&P 500 | 26.07% |

| Russell Mid Cap | 23.29% |

| Russell 2000 | 20.02% |

| NASDAQ Composite | 34.26% |

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested.

As you can see, trailing returns are closer to long-term US equity return averages compared to 2021, which should bode well for future return prospects.

In summary, the current market environment has notable distinctions from that of 2021 and early 2022. Despite potential reservations about investing at market peaks, it’s important to remember that the stock market regularly achieves all-time highs, and today’s “peak” will inevitably be surpassed by a new market high in the future.

Ultimately, when your objective, like ours, is to preserve and compound capital over the long term, it necessitates investors to stay invested irrespective of market conditions. This has been our philosophy for the last 50 years and will continue for the next 50.

Thank you for allowing us to be your trusted investment partner.

Will Preston, CFA®

Portfolio Manager, FAM Dividend Focus Fund

Securities offered through Fenimore Securities, Inc. Member FINRA, and advisory services offered through Fenimore Asset Management, Inc.

Important Disclosures

Performance data quoted above is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current to the most recent month-end for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

Please consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The FAM Funds prospectus or summary prospectus contains this and other important information about each Fund and should be read carefully before you invest or send money. To obtain a prospectus or summary prospectus for each fund as well as other information on the FAM Funds, please go to fenimoreasset.com or call (800) 932-3271.

This presentation was prepared exclusively for the benefit and use of Fenimore Asset Management, Inc. (“Fenimore”) and FAM Funds clients to whom it is directly addressed and delivered and does not carry any right of publication or disclosure, in whole or in part, to any other party. Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore.

In part, the purpose of this presentation is to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds.

These materials contain the views and opinions of Fenimore. Additionally, the information herein is subject to change and is not intended to be complete or to constitute all of the information necessary to evaluate adequately the consequences of investing in any securities or other financial instruments or strategies described herein. These materials also include information obtained from other sources believed to be reliable, but Fenimore does not warrant its completeness or accuracy. In no event shall Fenimore be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you in evaluating the merits of participating in any transaction.

We undertake no duty or obligation to publicly update or revise the information contained in this presentation. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of Fenimore funds, or information about the market, as indicative of future results.

All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions and does not reflect actual investment results and is not a guarantee of future results. Actual results will vary with each use and over time, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment, or accounting advice.

There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

As we approach the middle of the year, we thought it would be appropriate to provide an update of what we are seeing, hearing, and thinking regarding the economy and your portfolios.

Following the close of Q1, our in-house investment research team has been busy parsing through 100+ earnings calls and transcripts from the companies they follow. No doubt, we did hear signs of moderation, particularly towards the end of the quarter. This moderation is being felt across a wide range of industries including industrial distribution, technology hardware, healthcare analytical equipment, and consumer facing businesses—particularly those impacted by higher interest rates like used autos and homebuilding supplies. In some cases, moderation means that businesses in these industries will grow at a slower rate, while in other cases certain businesses may see a decline compared to the high levels of activity achieved in 2021 and 2022.

Marc Roberts, CFA®

Portfolio Manager, FAM Value Fund

Encouragingly, despite signs of moderation, we heard an equal amount about resiliency. Consumer spending and the labor market has remained robust, despite the pace of interest rate increases aimed at combating higher levels of inflation. Resiliency was felt across several industries including insurance brokerage, health care procedures, travel, and general industrial. For some businesses, positive results are being driven by continued solid demand, while others are benefiting more from latent pricing power. Our focus on investing in businesses that possess differentiated attributes has helped with navigating this dynamic environment and we’ve been pleased with our companies ability to get the appropriate value for the products and services they provide.

Resiliency has not only been present in the economy, but in the stock market as well. Despite news headlines and concerns at the macroeconomic level, the broader market has achieved gains year to date.

LOOKING AHEAD

We continue to monitor the ongoing developments in the banking and commercial real estate industries (read our latest banking update). Tightening credit standards and greater risk aversion may have been a culprit behind the moderation that corporate America began feeling late in the quarter and could serve to further moderate activity going forward.

At Fenimore, we know that we can’t predict potential macro eventuality. However, we continue to have high conviction in our ability to mitigate risk, and our approach to selecting quality, resilient businesses. We remain confident that over the long-term, our businesses and the leadership teams behind them can drive long-term value creation, that is expected to benefit our collective portfolios.

STAY CONNECTED

If you have any questions about your investments, you can call 800-721-5391, email us at info@fenimoreasset.com, or stop by either our Albany or Cobleskill location.

Thank you for your ongoing trust and we hope you have a safe and enjoyable summer.

John Fox, CEO joins Amanda Blanton, Marketing Director at the Adirondack Regional Chamber of Commerce to discuss Fenimore, investing, and our community on the ‘I’m in with the ARCC’ radio show.

Interview Highlights Include:

How Fenimore Asset Management began and how we continue to serve individuals, families, businesses, and institutions

Fenimore’s commitment and support of our local community

Investing tips

Our long-term investing strategy and how we invest

What makes Fenimore different?

Securities offered through Fenimore Securities, Inc. Member FINRA, and advisory services offered through Fenimore Asset Management, Inc.

Past performance is not indicative of future results. All investing involves risk including the possible loss of principal. Before investing, carefully read the fund’s investment objectives, risks, charges and expenses. FAM Funds’ prospectus or summary prospectus contains this and other important information about FAM Funds and should be read carefully before you invest or send money.

To obtain a prospectus or summary prospectus and performance data that is current to the most recent month-end for each fund as well as other information, please go to fenimoreasset.com or call (800) 932-3271.

The principal risks of investing in the fund are: stock market risk (stocks fluctuate in response to the activities of individual companies and to general stock market and economic conditions), stock selection risk (Fenimore utilizes a value approach to stock selection and there is risk that the stocks selected may not realize their intrinsic value, or their price may go down over time), and small-cap risk (prices of small-cap companies can fluctuate more than the stocks of larger companies and may not correspond to changes in the stock market in general).

Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of Fenimore. The description of certain aspects of the market herein is a condensed summary only. This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any security or other financial instrument. This summary is not advice, a recommendation or an offer to enter into any transaction with Fenimore or any of their affiliated funds. This presentation may contain statements based on the current beliefs and expectations of Fenimore’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Any references herein to any of Fenimore’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice.

As we celebrate National Women’s History month, we want to take the time to acknowledge our female investors, friends, and colleagues at Fenimore Asset Management. We believe women have never been in a better position to achieve financial independence for themselves and their families.

The Fenimore team is currently 43% female comprising of women employees across all departments including members of the management team as well as Deb Pollard, Fenimore’s President. We are very proud of this statistic as we all move towards bridging the gaps in the financial services industry.

Our team knows firsthand some of the unique challenges women can face.

Some women have handled the family’s finances all along, while others may be new to the world of investing. No matter your level of expertise, there’s always room to learn more and adjust your plan based on your current circumstances:

If you are a beginning investor:

If you are a more experienced investor:

The team at Fenimore Asset Management is here to help.

Fenimore Asset Management does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. There can be no guarantee that the investment objectives of Fenimore will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Clients or prospective clients should consider the investment objectives, risks, and charges and expenses carefully before investing. You may obtain a copy of the most recent mutual fund prospectus by calling 800-932-3271 and/or visiting www.fenimoreasset.com.

Fenimore Asset Management Inc. is an SEC registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made.

By John Fox, CFA®

CEO

After a terrific 2021, the stock market peaked on the first business day of the new year and has been declining ever since. So far, stocks are down 10% to 20% for the year depending on the index you watch.[1] The stocks of smaller companies have fallen the most.

While the current headlines are on Russia’s invasion of the Ukraine, we believe this is just one of multiple reasons for the drop in stock prices. As long-term stock investors, it’s always helpful to remember that price declines are part of the experience. I mentioned in a recent video we distributed that I have been at Fenimore for 26 years and in every one of those years, but one, the market had a decline of 5% or more during the year. This is a normal part of stock investing.

Of course, the reasons for the declines are always different. Today, we see three primary reasons:

1) High Valuations: After great market returns in 2021, stock valuations were at a high level. Because of low interest rates and many years of terrific returns, investors were willing to pay more for a dollar of earnings. This left stock prices at an all-time high and susceptible to a decrease as we turned the calendar. It’s impossible to know when a decline might occur, even if you think prices look high.

2) High Inflation: It’s very clear that inflation is not “transitory” using an often-quoted word from the Federal Reserve Chairman. We believe some parts of inflation will recede over time; other factors are here to stay. As a consequence, the Federal Reserve will be raising interest rates this year beginning at their March meeting in a few weeks. Answers to important questions like how high these rate increases will go and how fast they will occur are unknown. Interest rates have already moved up in anticipation of the Fed’s moves. The 30-year mortgage rate has increased from last year’s low of 2.67% to 4% today.[2] We should point out that while the Fed is raising interest rates, they remain low by historical standards.

3) Russia’s Invasion: Russia’s invasion of Ukraine creates a lot of uncertainty around politics and Europe’s state of affairs. From a purely economic point of view, Russia is a major producer of oil and other commodities like wheat. If this conflict continues, it may increase the prices of these commodities which will impact inflation. Higher inflation brings us right back to the previous point about an interest rate increase.

As you can see, there are a number of interrelated issues. However, even if it seems like one storm ends and another surfaces, this is usually the story in economics, politics, and markets. We have been through numerous international events like the Asian financial crisis in 1998 and two wars in Iraq.

Looking Ahead

At this time, we expect companies to grow earnings over 2021 levels and generate cash profits to invest in growth and return to shareholders through stock buybacks and increased dividends. As I stated in our year-end newsletter, “You don’t have to know the future, but you do have to know your companies.”

This gives us the confidence we need to execute our long-term strategy: investing in what we believe are quality businesses that meet our rigorous financial standards with strong leadership teams that can create value for our investors over time.

Please contact us at 800-721-5391 if you have questions or concerns. Thank you for the opportunity to serve you.

[1] FactSet as of 2/24/2022

Did you know that, if you are at least 70½ years old, you can make tax-free charitable donations directly from your IRA? By making what’s called a qualified charitable distribution (QCD), you can benefit your favorite charity while excluding up to $100,000 annually from gross income. These gifts, also known as “charitable IRA rollovers,” would otherwise be taxable IRA distributions.1

In order to make a QCD, you simply instruct your IRA trustee to make a distribution directly from your IRA (other than SEP and SIMPLE IRAs) to a qualified charity. The distribution must be one that would otherwise be taxable to you. You can exclude up to $100,000 of QCDs from your gross income each year. And if you file a joint return, your spouse (if 70½ or older) can exclude an additional $100,000 of QCDs. Note: You don’t get to deduct QCDs as a charitable contribution on your federal income tax return — that would be double-dipping. QCDs count toward satisfying any required minimum distributions (RMDs) that you would otherwise have to receive from your IRA, just as if you had received an actual distribution from the plan. However, distributions that you actually receive from your IRA (including RMDs) and subsequently transfer to a charity cannot qualify as QCDs.

Without this special rule, taking a distribution from your IRA and donating the proceeds to a charity would be a bit more cumbersome and possibly more expensive. You would request a distribution from the IRA and then make the contribution to the charity yourself. You’d include the distribution in gross income and then take a corresponding income tax deduction for the charitable contribution. But due to IRS limits, the additional tax from the distribution may be more than the charitable deduction. And due to much higher standard deduction amounts ushered in by the Tax Cuts and Jobs Act passed in 2017, itemizing deductions may have become even less beneficial in 2018 and beyond, rendering QCDs even more potentially appealing. QCDs avoid all this by providing an exclusion from income for the amount paid directly from your IRA to the charity — you don’t report the IRA distribution in your gross income, and you don’t take a deduction for the QCD.

Fenimore Asset Management does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

1 Beginning after 2019, if you make deductible contributions to an IRA for the year you reach age 70½ or beyond, this could reduce the allowable amount of your QCD.

The Fenimore team was excited to kickoff summer by planting flowers outside the Cobleskill Regional Hospital. We sincerely hope the beautiful flowers and bright colors serve as a welcome sight for patients, visitors, and our healthcare workers.