Earlier this year, with COVID-19 cases on the decline and federal stimulus checks in hand, consumers rushed back into the marketplace — buying homes and cars, taking vacations, and attending all sorts of events. This was great for business. Sales were up, corporate profits jumped, and stock prices rose along with them. Until companies just could not keep up.

The reason is when the economy shut down, so did production lines. Then, when consumer demand exploded, manufacturers could not ramp up fast enough or find the employees they needed. Demand is simply outpacing supply. For example, automakers cannot obtain the semiconductors they need to build cars. Homeowners looking to upgrade appliances often cannot find what they need. As a result, people are suddenly spending less.

At the same time, businesses dealing with staffing shortages are reducing hours, further dampening sales. And now the upswing in COVID-19 cases is sending more people back into the safety of their homes and impacting restaurant seatings, air travel, and other elements of the mobile economy. Combined, these economic disruptions have forced some companies to downgrade their earnings estimates and this has slowed stock market growth.

What the fall has in store for us is impossible to predict — and certainly we are concerned about the resurging health impacts of the virus — but in our view the long-term outlook remains bright. Demand for consumer products is still high and the supply chain kinks should get straightened out. Quality businesses typically adapt, continue to grow, and should be bigger and more profitable five years from now than they are today.

We believe this bodes well for the FAM Funds. Our research team seeks quality companies with solid financial footings that we think are ideally positioned to weather any storm and deliver strong results over time. We focus not on the random, day-to-day, short-term turbulence in the economy or market, but on the businesses behind the stocks.

Have there been some unanticipated changes in recent weeks? Sure. But they do not alter our long-term vision. We believe we will take another two steps forward … And the shelves will once again be completely stocked.

Announcing a transition

Fenimore Founder and Executive Chairman Tom Putnam built the framework for a long-term succession plan many years ago to ensure continuity of experience and investment philosophy for years to come. I am pleased to announce the latest step in this plan.

Longtime Fenimore Investment Research Analyst Marc Roberts has been named as a Portfolio Manager of the FAM Value Fund. Marc served successfully in the same role for the FAM Small Cap fund from 2012 to 2016 before relocating to Chicago. He returned to us last year and quickly re-established himself as a key member of our research team. Marc joins me and Drew Wilson in managing the fund.

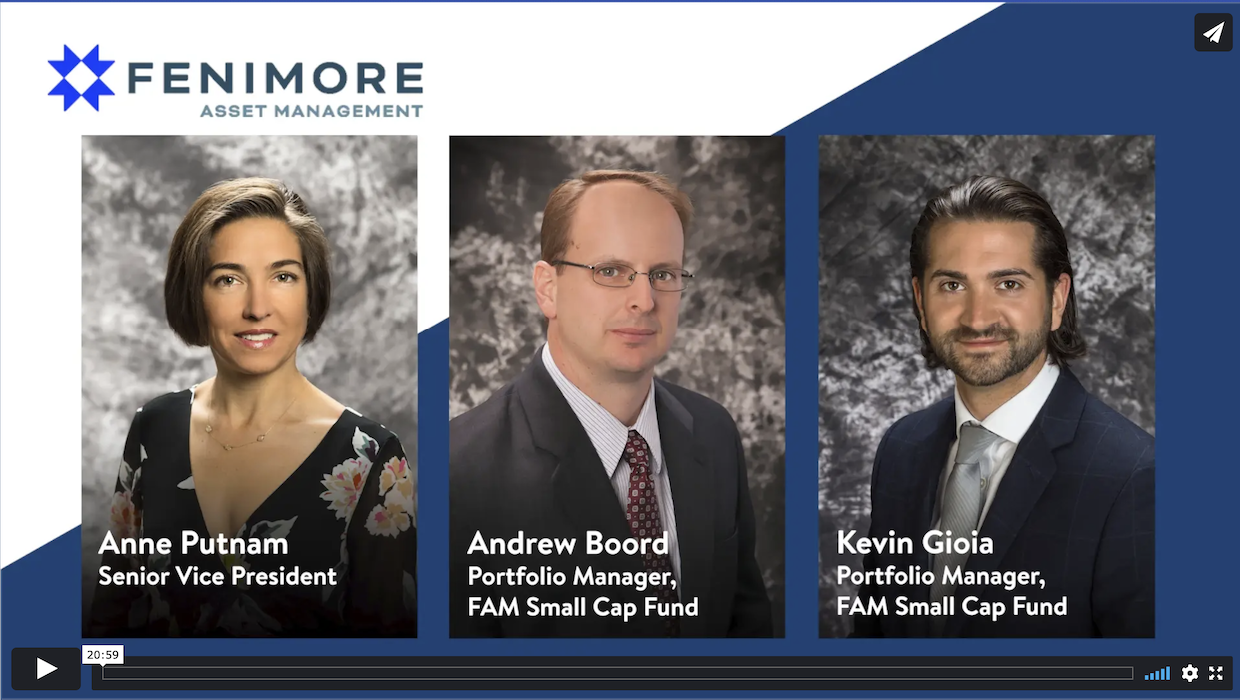

At the same time, Tom has announced that he will transition away from being a portfolio manager on our funds at the end of 2021 to concentrate fully on his Executive Chairman role. He will continue to be a mentor and an active participant in our research process and strategic direction. The rest of our fund management teams, including those of us who have led these teams for several years, will remain in place. Paul Hogan and Will Preston manage the FAM Dividend Focus Fund and Andrew Boord and Kevin Gioia the FAM Small Cap Fund.

We look forward to continuing Tom’s well-established tradition of collaborative, team management of the FAM Funds and to working diligently every day as we seek to grow your wealth over time.

Lets connect

We value the personal connections we have with our shareholders. You can reach us with any questions at 800-932-3271, through the contact us section of our website, or via info@fenimoreasset.com. Our team also welcomes you to meet with us in either our Albany or Cobleskill office or via Zoom.

We hope to hear from you soon. Thank you for your continued confidence in us.

Sincerely,

John D. Fox, CFA

CHIEF EXECUTIVE OFFICER