SHIRKING THE WAVE, SEEKING LONG-TERM VALUE

Long-term asset growth for our investors has been one of Fenimore’s defining goals since our founding in 1974. The effects we are seeing today come from the seeds we planted — and the discipline we exercised — two and three years ago. That’s when we avoided buying so-called “pandemic winners,” such as ultra-hot businesses that we viewed as speculative, were thriving on low interest rates, or were saddled with much debt. Instead, our team held firmly to our steadfast investment philosophy that has guided us for nearly a half-century.

For example, many people hopped on the technology wave during COVID. One stock went from a $100 per share in 2019 to nearly $600 during 2020’s last quarter. Today, it’s right back to where it started. The wave crashed. For this specific firm, there was simply no long-term value in our view — and we’re looking to create long-term value for our investors.

OUR MARKET-TESTED APPROACH

Fenimore seeks to invest in quality small to mid-size companies that are available at a price below what we estimate to be their intrinsic value. We define “quality” as companies that have:

- Business models we understand, strong balance sheets, clear competitive advantages, free cash flow, and growing cash profits.

- The potential to thrive in the best economic times and weather the inevitable storms to deliver long-term, sustainable growth.

- Established and ethical management teams that we know, welcome our visits and questions, and talk candidly with us about their opportunities and challenges.

A STATEMENT OF CONFIDENCE

As we head into the fourth quarter, our research team continues to hit the road and phone to talk with the companies we own and those we’re considering buying — gathering insights into their businesses, fact-checking our instincts, and seeking to ensure that the investments we’re making on your behalf meet Fenimore’s stringent criteria.

In just the week before I’m writing this, we visited with five companies including a swimming pool supplier, software developer, and an electronic parts manufacturer. Each time we came away with strengthened confidence in their long-term potential and the role they play in delivering value to our investors.

We are optimistic that inflation could be under control next year, and economic growth and business fundamentals will be the main topics of discussion. Meanwhile, our analysts are avoiding industries that are sensitive to interest rates and susceptible to credit losses. We are planting quality seeds that we believe should produce value over time.

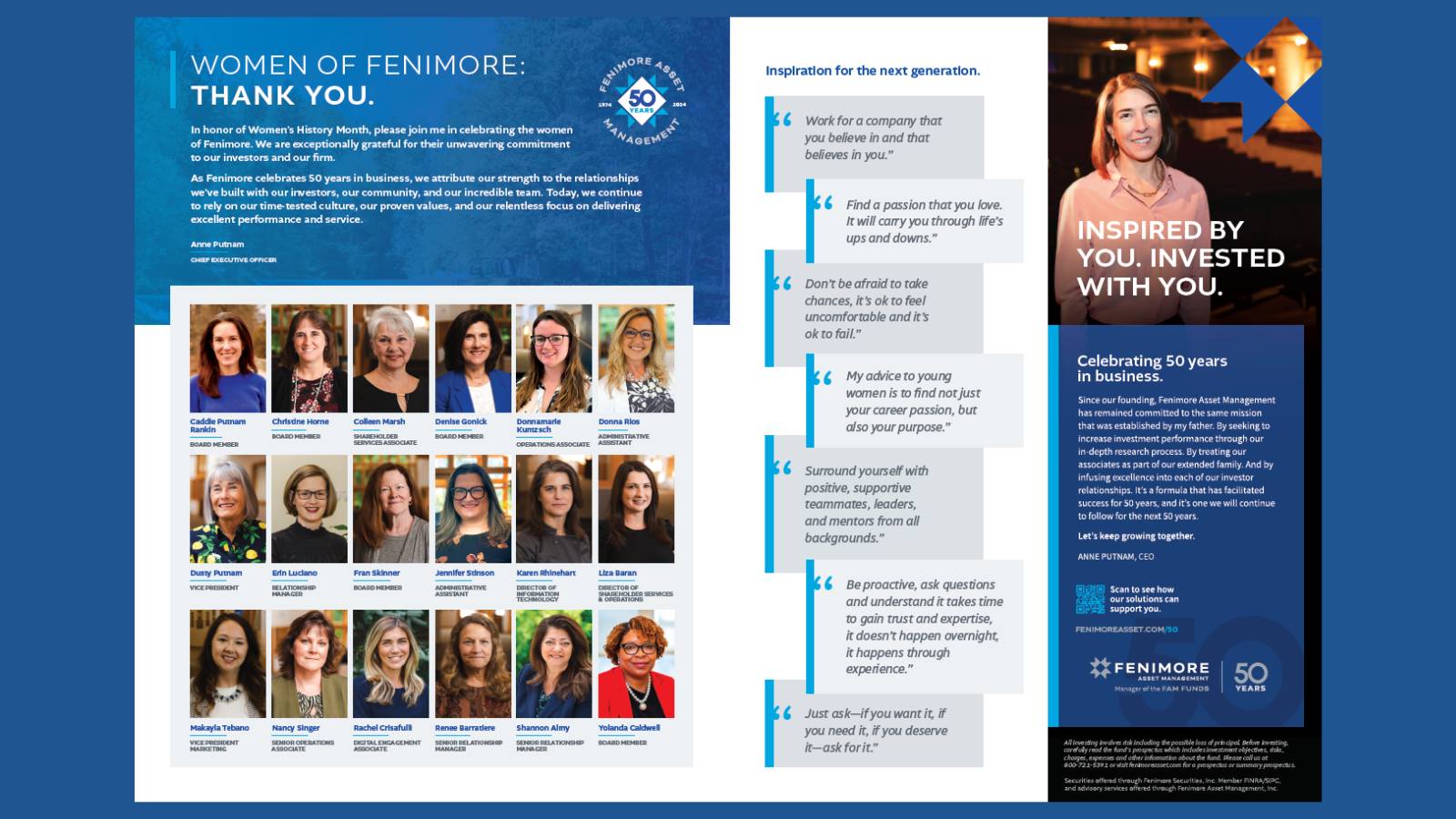

OUR NEW CEO

As Fenimore looks ahead to an exciting future, it’s my pleasure to congratulate Anne Putnam on her promotion to Chief Executive Officer (CEO), effective October 1, 2023.

A second-generation Fenimore leader and founding family member, Anne grew up in the firm her father, Tom Putnam, founded. After earning her professional credentials outside our walls, she returned 17 years ago to help us chart our future. Anne has contributed significantly to Fenimore’s growth, most recently as Senior Vice President since 2017. She has played a key role in maintaining and enhancing our strategic vision and value investment philosophy, as well as our enduring commitment to community philanthropy.

What’s next for me? After serving in the dual roles of CEO and Chief Investment Officer (CIO) since 2019, I am pleased to focus full time on my CIO role and the work I love most — guiding the firm’s investment management strategies and leading our talented research team as we seek quality companies that we believe should provide long-term value for our investors.

LET’S TALK

Any time you have questions or want to talk about your investments, please visit us in either our Cobleskill or Albany office, call 800-932-3271, or email us at info@fenimoreasset.com.

Best wishes for a wonderful conclusion to 2023 and thank you for your confidence.

Sincerely,

John D. Fox, CFA®

CHIEF INVESTMENT OFFICER